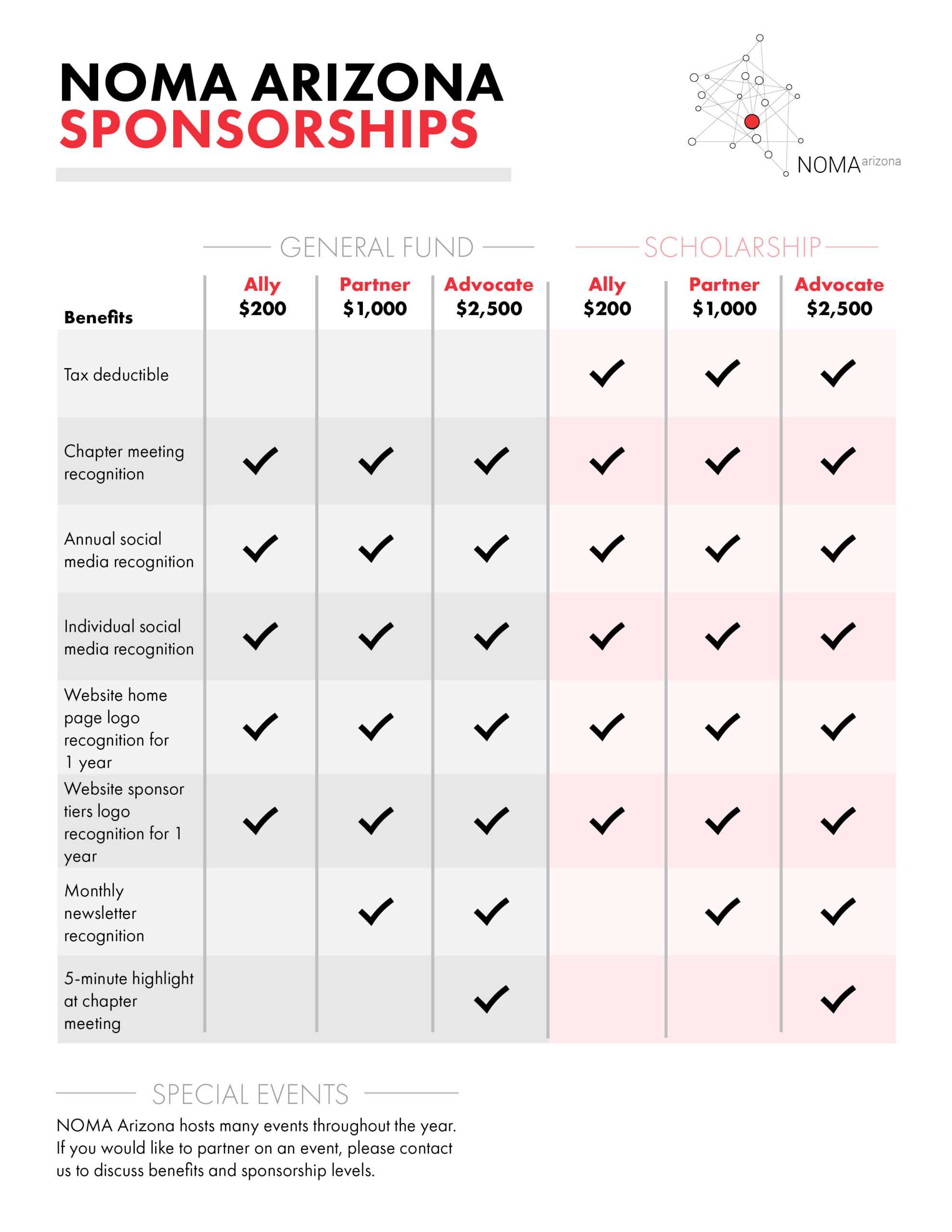

Donations

Scholarship Donations

How Your Donation Makes an Impact

Your Donations Make a HUGE Impact

Non-Profit Donation Disclaimer

NOMAarizona is a professional nonprofit organization under section 501(c)(6) of the IRS tax code. As such, contributions (i.e., donations) made directly to NOMAarizona are NOT deductible as charitable contributions on a donor’s federal income tax return. They may be deductible as trade or business expenses if ordinary and necessary in the conduct of the taxpayer’s business. The donee organization may be required to make certain disclosures and pay a proxy tax in connection with the dues payment.

For more information, refer to IRS section “Tax Treatment of Donations – 501(c)(6) Organizations.”

Important Notice: Donations made to NOMAarizona are vital for supporting our mission and ongoing initiatives. However, because we are classified as a 501(c)(6) organization, these contributions do not qualify for tax deductions as charitable contributions. We strongly encourage donors to consult with their tax advisors to understand the full implications of their donations and to explore alternative ways to support our cause that may be tax-deductible.

Tax-Deductible Contributions: If you wish to make a tax-deductible donation, you may contribute to a qualified 501(c)(3) organization affiliated with NOMAarizona. This organization is the Social Good Fund, which serves as a philanthropic partner to NOMAarizona to facilitate our Scholarship Fund that supports our John R. Williams Scholarship, ARE Scholarships, Project Pipeline, and AZ Kidsbuild programs.

Donations to a 501(c)(3) entity are tax-deductible to the extent permitted by law.

Scholarship Donations

The Scholarship Fund supports our local students pursuing higher education in the design and construction industry, as well as emerging professionals taking their Architectural Registration Exams. In addition, this fund provides financial backing for our K-12 Programs so that there is no cost for students to attend camp. Scholarship Donations are tax-deductible.

GENERAL FUND DONATIONS

The General Fund supports our operational costs such as website maintenance, virtual meeting platforms, Professional Development Workshops, and Community Service Initiatives. General Fund Donations are not tax-deductible.

Thank You Advocate Sponsors